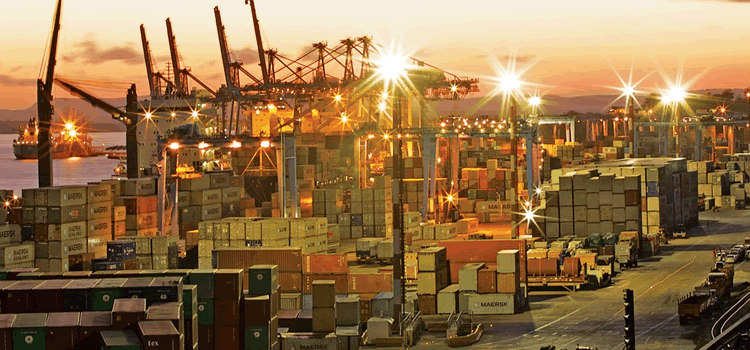

All Ugandan based imported cargo will be insured locally from April this year following a successful probation of 3 months that started in January this year. This will be the 3rd East African country to enforce the insurance laws that requires purchase of Marine Cargo Insurance cover from the local underwriters.

Kenya was the first country to enforce this directive in 2017 followed by Tanzania although the performance of the sector in the two countries has not posted envisaged results.

“Effective January 2020, all imports must have a valid marine insurance cover underwritten by a Ugandan registered insurance company before clearance by Uganda Revenue Authority (URA),” Insurance Regulatory Authority (IRA in Uganda announced late last year.

The new requirement makes it easier for importers to lodge claims with Ugandan insurers as opposed to the cumbersome procedure of lodging insurance claims with foreign insurers for lost or damaged goods, Steven Kaddumukasa, senior inspection officer at IRA was quoted by Ugandan press.

He said similar legislation has been effected in Kenya and has promoted demand for marine insurance, which can be said to have contributed to a 41.5 % increase in MCI premium in 2017 in Kenya.

However, Intergovernmental Standing Committee on Shipping (ISCOS), a regional body that draws its membership from Zambia, Uganda, Kenya and Tanzania, said that this declined in 2018 due to under-cuttings by underwriters as well as weak enforcement mechanisms by the responsible agencies.

Burundi, Democratic Republic of Congo (DRC), Kenya, Rwanda, Tanzania, Uganda, Malawi and Zambia, according to ISCOS, exported insurance premiums on marine cargo worth US $ 4.89 billion (KES 489 billion) over a period of 5 years between 2009 and 2013.

Efforts to have Kenya’s government compel all importers to buy marine insurance locally started in 2013. This was not a Kenyan problem but a regional one.

ISCOS, in March 2015, wrote to the governments of Kenya, Uganda, Tanzania and Zambia, pointing out that there was legislation in each member state requiring importers to procure marine cargo insurance locally and proposed action to be taken to remedy the situation.

Fortunately, Kenya took action and the Treasury Cabinet Secretary finally issued the policy directive to on-shore marine cargo insurance in his 2016-17 budget speech.

Agencies that supported this initiative included the Association of Kenya Insurers (AKI), Insurance Regulatory Authority (IRA), Shippers Council of East Africa (SCEA), Kenya Maritime Authority (KMA), Association of Insurance Brokers and the Director of Budget.

According to the Uganda Insurance Act 2011, all exporters and importers are required to take marine insurance with local companies, but various agencies particularly the IRA and URA have not enforced compliance with this law.

Worldwide, many countries have legislation protecting their local insurance industries. In such cases, countries opt out of international treaties which would require them to ‘liberalise’ their insurance markets – a situation which only benefits foreign, more-developed insurance industries in exporting countries.

Local insurance for marine cargo makes claims settlement easy and low costs of processing, due diligence and general administration. “More employment opportunities will be created locally. A strong insurance sector means a stable and resilient economy. Local insurance companies shall use a percentage of the marine insurance premiums (successfully retained) to invest in literacy and CSR,” Kaddumukasa said.

Other benefits include; right valuations under the insurance to help counter current practices of under-declaration of goods and hence loss of revenue. There would also be competitive and favorable premium rates arising from the economies of scale, eased communication flows, provision of Insurance Cover at appropriate premium rates as opposed to the existing loading of 1.5% flat rate for purposes of tax.

The Ministry of Finance is expected to provide guidance to URA to make provision for the MCI certificate on the URA Single Window System so that possession of local marine cargo insurance certificate will be one of the prerequisites before goods are cleared for entry.

Kenya has also been relying on its Single Window System. Once the ongoing integration with the Integrated Customs Management System of Kenya Revenue Authority (KRA) is fully completed, a higher level of compliance is expected.

The IRA is expected to make the MCI Guidelines, approve minimum premium rates for marine cargo insurance in collaboration with URA and to engage the insurers to ensure that they pay claims promptly.

In Uganda, the principle statute governing marine insurance is the Marine Insurance Act 2002. The Act defines a marine insurance contract as a contract whereby the insurer undertakes to indemnify the assured, in manner and to the extent thereby agreed, against the losses incident to marine adventure.

Kenya leads the East Africa marine market followed by Tanzania in view of their access to the coastline. In Uganda, all companies doing general insurance business were licensed to underwrite marine insurance. Marine insurance is the oldest class of general insurances. It is grouped with motor insurance as transport insurance.

For any feedback, contacts us via editorial@feaffa.com / info@feaffa.com; Mobile: +254703971679 / +254733780240